Offshore Company Formation: Trick Approaches to Increase Your Service

Offshore Company Formation: Trick Approaches to Increase Your Service

Blog Article

Insider Insights on Navigating Offshore Company Formation Successfully

Beginning on the journey of establishing an overseas firm is a critical choice that needs precise planning and implementation. The details associated with navigating the complexities of overseas business formation can be daunting for also seasoned business owners. Gaining expert insights from specialists who have actually successfully steered with the procedure can supply important advice and a competitive side in this field. As we explore the nuances of choosing the ideal territory, comprehending lawful needs, taking care of tax obligation effects, establishing financial connections, and making sure compliance, a wealth of expertise waits for those looking for to understand the art of offshore company formation.

Selecting the Right Jurisdiction

When considering overseas business development, selecting the appropriate jurisdiction is a vital decision that can considerably impact the success and procedures of business. Each territory uses its very own collection of legal structures, tax obligation regulations, personal privacy laws, and monetary incentives that can either hinder a business or profit's objectives. It is important to perform complete research and seek professional guidance to make certain the selected territory lines up with the business's demands and objectives.

Factors to consider when picking a jurisdiction consist of the economic and political security of the area, the ease of working, the degree of monetary personal privacy and discretion provided, the tax obligation ramifications, and the regulatory environment. Some jurisdictions are known for their desirable tax obligation frameworks, while others focus on privacy and asset protection. Understanding the special features of each territory is vital in making an educated choice that will certainly sustain the long-lasting success of the offshore company.

Ultimately, selecting the right territory is a critical action that can give possibilities for development, possession protection, and operational performance for the overseas company.

Understanding Lawful Demands

To make sure compliance and legitimacy in overseas business development, an extensive understanding of the legal demands is imperative. Various territories have differing legal structures regulating the establishment and procedure of overseas companies. It is vital to conduct detailed research study or seek specialist recommendations to understand the specific lawful stipulations in the picked jurisdiction. Usual legal requirements might include signing up the company with the proper governmental bodies, adhering to anti-money laundering laws, preserving exact financial documents, and fulfilling tax obligation obligations. In addition, understanding the reporting needs and any type of essential disclosures to regulative authorities is critical for continuous conformity. Failure to abide by legal demands can bring about severe repercussions, such as penalties, penalties, and even the dissolution of the overseas company. Staying notified and up to day with the lawful landscape is important for efficiently navigating offshore business development and making certain the long-term sustainability of the company entity.

Navigating Tax Obligation Effects

Comprehending the elaborate tax obligation ramifications associated with overseas firm formation is critical for making sure compliance and optimizing financial approaches. Offshore business often give tax benefits, however browsing the tax landscape calls for extensive knowledge and appropriate preparation.

Furthermore, transfer rates policies have to be very carefully evaluated to make sure transactions between the overseas entity and relevant parties are performed at arm's length to prevent tax obligation evasion accusations. Some jurisdictions use learn this here now tax rewards for certain sectors or activities, so comprehending these motivations can help take full advantage of tax obligation savings.

Furthermore, remaining up to date with advancing international tax policies and conformity needs is important to prevent fines and maintain the company's credibility. Looking for specialist suggestions from tax obligation experts or specialists with experience in offshore tax matters can offer useful understandings and make certain a smooth tax obligation preparation procedure for the overseas firm.

Establishing Financial Relationships

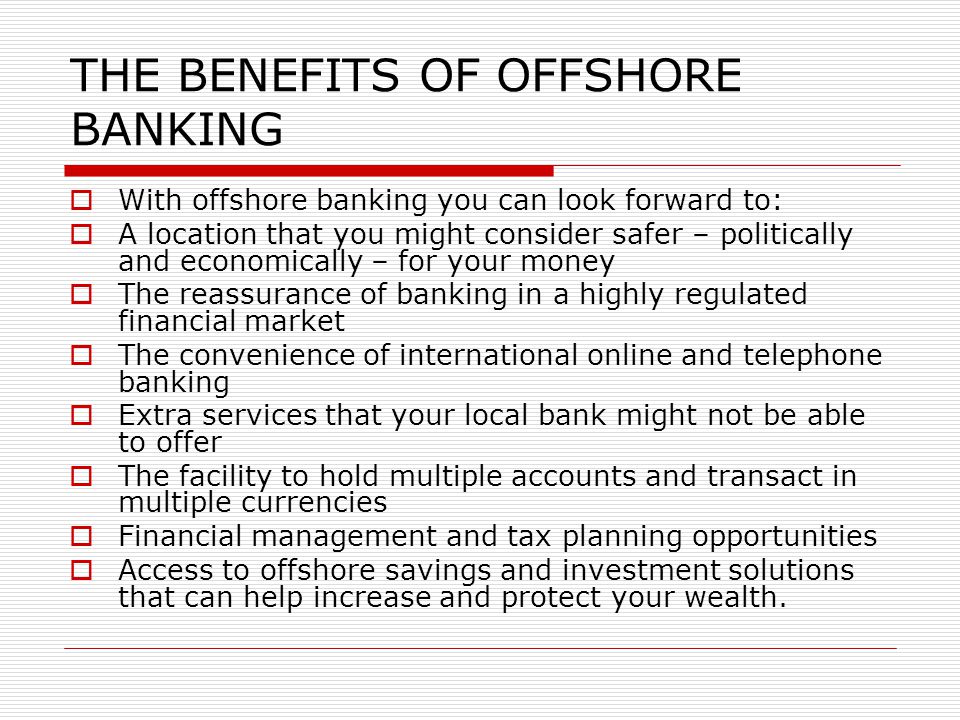

Developing trustworthy and safe and secure financial partnerships is a critical action in the procedure of overseas business formation. offshore company formation. When establishing financial partnerships for an overseas business, it is vital to select credible banks that provide services customized to the certain requirements of international businesses. Offshore business typically call for multi-currency accounts, on the internet banking centers, and seamless worldwide deals. Selecting a financial institution with a worldwide visibility and expertise in taking care of overseas accounts can ensure and simplify monetary procedures compliance with international guidelines.

Furthermore, prior to opening a savings account for an overseas company, detailed due persistance treatments are normally required to validate the Discover More Here legitimacy of the business and its stakeholders. This may entail offering in-depth documentation regarding the business's tasks, resource of funds, and advantageous proprietors. Constructing a cooperative and clear partnership with the picked bank is key to navigating the complexities of overseas financial efficiently.

Guaranteeing Conformity and Coverage

After developing safe and secure banking relationships for an offshore business, the next important action is making certain conformity and reporting measures are meticulously followed. Compliance with regional legislations and worldwide policies is critical to maintain the legitimacy and reputation of the overseas entity. This consists of sticking to anti-money laundering (AML) and know your customer (KYC) needs. Normal reporting responsibilities, such as monetary statements and tax filings, have to be fulfilled to remain in great standing with regulative authorities. Engaging economic and legal professionals with knowledge in offshore territories can assist navigate the intricacies of conformity and reporting.

Failure to abide by policies can lead to extreme charges, penalties, or perhaps the revocation of the offshore firm's license. Staying positive and attentive in guaranteeing conformity and coverage demands is important for the long-lasting success of an overseas entity.

Verdict

Finally, effectively navigating overseas company formation needs cautious consideration of the jurisdiction, legal needs, tax effects, banking connections, conformity, and coverage. By understanding these crucial elements and making sure adherence to laws, companies can establish a solid foundation for their overseas procedures. It is critical to look for professional support and competence to browse the complexities of offshore firm formation effectively.

As we dig right into the subtleties of picking the appropriate territory, understanding lawful needs, handling tax ramifications, developing banking connections, and making sure conformity, a wealth of knowledge awaits those seeking to grasp the art of overseas company development.

When taking into consideration offshore company navigate to this website development, picking the proper jurisdiction is a crucial choice that can substantially impact the success and operations of the company.Understanding the intricate tax implications linked with offshore firm formation is essential for making sure compliance and enhancing financial strategies. Offshore firms usually supply tax obligation advantages, yet navigating the tax landscape needs complete understanding and appropriate preparation.In conclusion, efficiently browsing offshore company development needs cautious factor to consider of the territory, lawful needs, tax obligation effects, banking relationships, conformity, and reporting.

Report this page